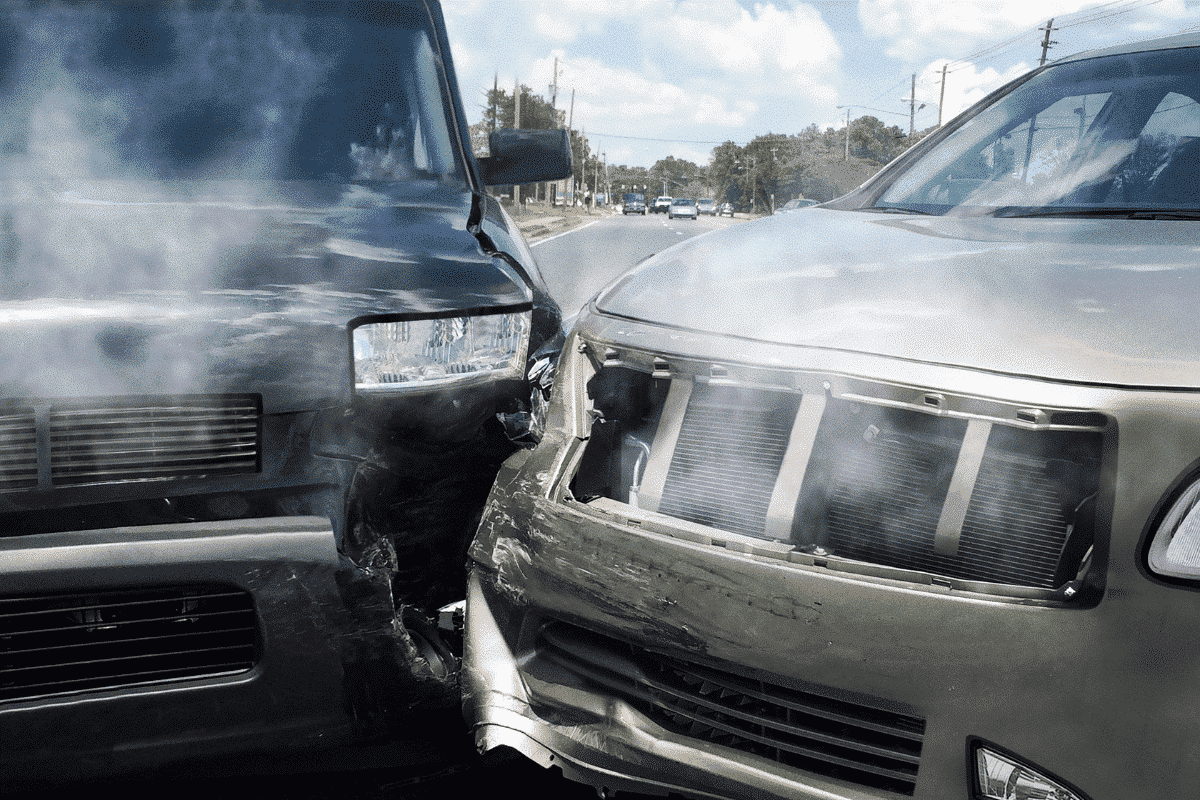

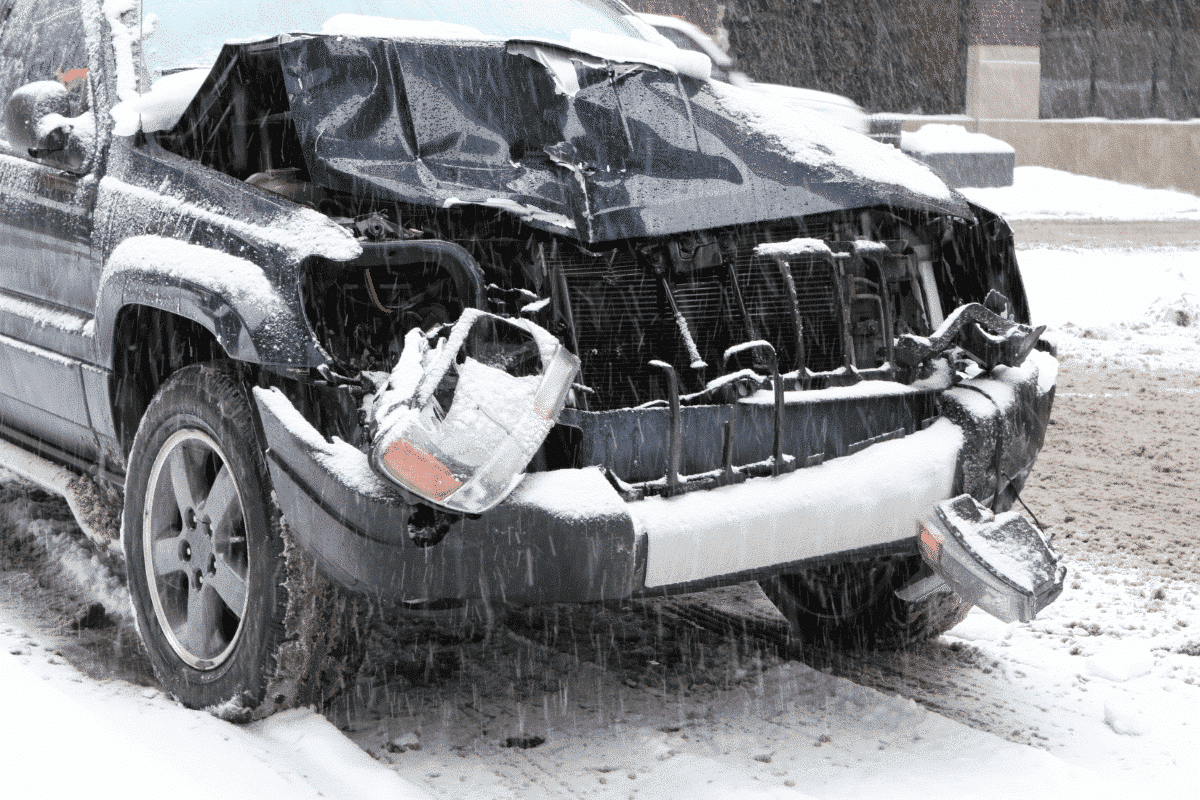

If you’ve just been in a car accident, you’re likely overwhelmed. You may need to seek medical attention if you were injured. You may also be contending with work and family problems if you don’t have access to a car.

Insurance companies know that you’re overwhelmed and probably not very well-versed in the insurance claims process. They’ll take every chance they can get to pay you as little as possible, even if you’re entitled to more. By being aware of some of the most common insurance tricks, you can be fully prepared when you file a claim.

Following are a few things you should be on the lookout for:

Trying to Get on Your Good Side

When you’re recovering from an accident, you want to hear that someone’s on your side. That’s why you’ll often get a call from the adjuster asking about your health. They may even make a few calls over the months, trying to make it appear as though they really care about your recovery and wellbeing.

Don’t be fooled – the insurance company doesn’t really care about your recovery. All that they want is to pay you less money. The adjuster may want you to settle for a smaller amount of money, admit wrongdoing, or downplay your injuries. No matter what the adjuster is telling you, don’t allow yourself to believe that they genuinely care about your health.

Convincing You That a Lawyer Is a Waste of Money

You’re negotiating with the insurance company to cover a lot of expenses. You need to buy a new car, pay off medical bills, cover the cost of living for any time you were unable to work, and potentially even set up funds for the future if you’ve become permanently disabled. An attorney’s fee, the insurance company will argue, is just spending extra money.

The thing is, that’s not true. Insurance companies will prey on the fact that you don’t know the legal system or claims process very well, convincing you to settle for less than you’re owed. A good auto accident attorney knows the ins and outs of the system and usually is able to increase the amount of money you receive at a fair cost.

Rushing Statements and Record Submissions

As soon as the accident happens, the insurance adjuster will probably start asking you for statements and records. Recorded statements made in a confused state may be used in the future to discredit you, and rushing your injury assessments may not leave time for an accurate assessment of long-term repercussions.

There’s a statute of limitations for auto accident claims, and as long as you prepare your documents and file your lawsuit within that time, you may pursue your case.

When it comes to dealing with insurance companies, you need the experienced auto accident attorneys at Warner Law Offices to be on your side, so you can receive what you’re truly owed.

Source: PersonalInjury.com